Among the many factors economic developers must consider for future business development opportunities are changes in global market trends. Trends in technology, supply chain or production capacity rarely change overnight, but closely following target industries can assist economic developers anticipate and prepare for the deals of the future.

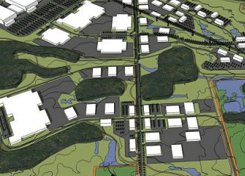

Invest Buffalo Niagara and our partners at Genesee County Economic Development Center (GCEDC) are working with many economic development, infrastructure, workforce, technology, and education partners to ensure the Western New York/Finger Lakes super region positions itself to be a leading site destination for semiconductor and nanotechnology expansion projects at the Western New York Science and Technology Advanced Manufacturing Park (WNY STAMP).

The team at GCEDC has already dedicated 11 years and over $50 million in planning and infrastructure development at the WNY STAMP Campus for critical site readiness initiatives, including site acquisition, environmental review, zoning and permitting considerations, and even archeological work. Our team has developed strong relationships with key contacts within the semiconductor sector through our participation at industry shows such as Semicon West and the Semiconductor Industry Association Annual Awards Dinner.

Dramatic market changes are currently underway in the semiconductor industry. TECHCET CA, an advisory service firm providing electronic materials information, forecasts a decline in silicon wafer supply for semiconductor device fabrication. The lag is estimated to amplify precipitously next year and remain as far out as 2021, even as the demand continues to increase rapidly. There are several factors contributing to this market shift, including the tightening of production capacity through strategic mergers and acquisitions and product diversification.

Thanks to the tightening – and soon to be shortage – in silicon wafer supply coupled with increased demand for the product, industry experts forecast a new round of significant capital investment by major manufacturers. These projects will include not only construction of new facilities, but also the expansion and upgrading of existing facilities. Additionally, process innovation will be necessary to meet production cost targets for a global market. In total, it is estimated the semiconductor industry will see its total CapEx exceed $70 billion over five years, between $6-$10 billion per new/expanded facility.

Thanks to the foresight and diligence of our partners at GCEDC, the WNY STAMP Campus is poised to attract investment from future semiconductor and nanotechnology expansion projects. The 1,250 acre mega-site, coupled with critical higher education and research and development assets, a trained workforce, and valuable incentive programs, make Western New York/Finger Lakes a leading region for business attraction.