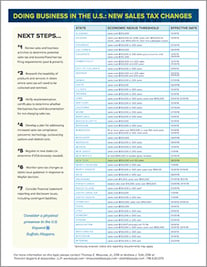

It has been over two years now since the U.S Supreme Court issued its landmark decision in the South Dakota v. Wayfair Inc. case and every state that imposes sales & use tax has enacted economic nexus thresholds for “remote sellers” with the exceptions of Florida and Missouri. A remote seller is any seller (foreign or domestic) that does not have physical presence in a state but who sells products or services for delivery to customers into that state.

Remote sellers whose sales exceed dollar or transaction thresholds in applicable states should evaluate their sales & use tax filing requirements and consider registering to collect and remit sales tax to avoid potential liabilities. Remote sellers who may have exposure related to prior sales or have received notices or nexus questionnaires from state taxing authorities should contact an experienced state tax advisor to discuss their compliance options, as states have different rules related to the imposition of economic nexus, the taxability of products and services and filing requirements.

Check out our YouTube playlist for more Can-Am expansion resources

Another development impacting remote sellers, particularly those who sell via online sales platforms like Amazon, eBay or Etsy, has been the rise of marketplace facilitator laws. Every state, except Florida, Kansas and Missouri, has imposed sales tax collection and remittance requirements on online sales platforms that meet certain qualifications, making these platforms responsible for actually collecting and remitting tax on sales they facilitate for third-party marketplace sellers. Understanding these laws is essential for remote sellers who sell online, as their filing requirements may be significantly different if their sales are exclusively with marketplace facilitators who are required to collect and remit tax on sales they facilitate.

For more information on this topic please contact Thomas E. Mazurek, Jr., CPA or Andrew J. Toth, CPA at Tronconi Segarra & Associates LLP | ww.tsacpa.com | tmazurek@tsacpa.com | atoth@tsacpa.com | 716.633.1373